Some customers are not great at paying on time. Therefore, there are times you need to follow up to receive what is owed to for you supplying your service or product. Now more than ever, the cycle of payments that exists in your community is very important because if you can’t get paid on time, you can’t pay on time and the circle grows and grows.

Follow up outstanding payments

In a message to Australian businesses Many Rivers CEO, John Burn said: “I want to encourage all the businesses that Many Rivers works with to be very careful to not just support their own business, but also other people’s businesses in the community too. This is not about survival of the fittest, rather it’s about survival of the community; it’s about working together and getting back to the fundamentals of what business is about.”

Getting paid on time starts when you first engage with your customer. Start your relationship with your customer the way you want it to continue by making sure you:

Ensure your payment terms are fair, clear and in writing

Effective accounting and billing procedures can prevent problems before they occur. Make sure that payment terms are stated upfront, clearly and in writing. Have a regular billing and follow-up schedule that follows those terms precisely. Make sure your customer understands payment terms at the time of the transaction.

Many Rivers CEO John Burn has a good rule for deposits. “Make sure your deposit covers your cost of materials. In the event of not being paid in full you may not get paid for your time, but at least you can pay for the materials that you purchased to do the job and don’t end up with not being able to pay your suppliers.”

Invoice as early as possible

Just as you have a billing schedule, assume that your customer has a schedule for processing invoices. A prompt invoice is less likely to be forgotten and more likely to be paid on time.

Encourage on time payments by giving a small discount for on time payments and charging a fee or interest for late payments

Make sure the fees or interest charges are in line with customary practice in your industry and geographic area and are fully disclosed on the initial invoice. Everyone loves a discount! To make this an effective practice for early payments, make sure that this too is fully disclosed on the initial invoice and consistently applied. Be sure to enforce these consistently.

Have an effective follow-up process

Ensure you have a follow-up process for overdue payments in place. This should be part of your basic accounting and billing practice. Plan for the levels of escalation with specific times — 14 days overdue, 30 days, 60 days and so on.

How do you follow up your outstanding payments (unpaid invoices)?

Politely, and with some scripts. By writing down what you want to say beforehand and using email and phone calls in the right way you can make this process a lot easier.

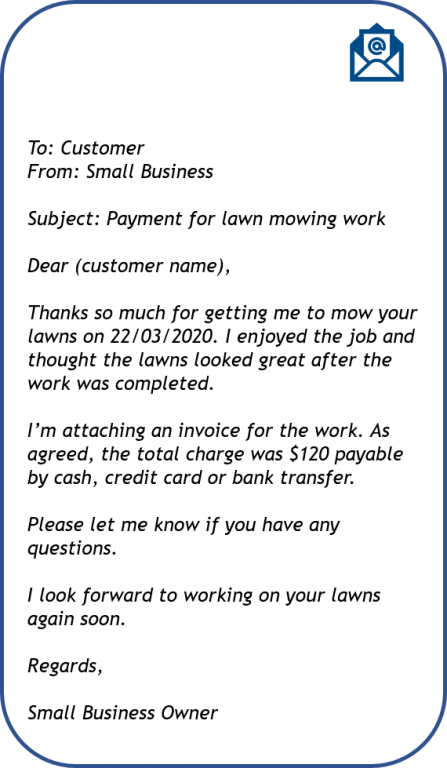

Here are some templates to use:

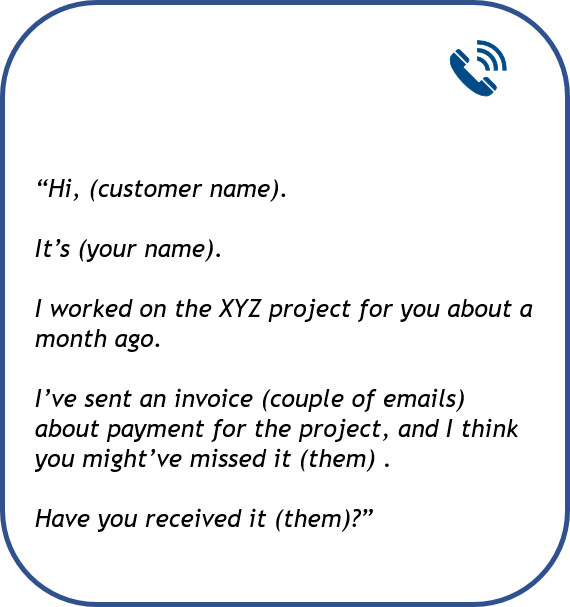

Phone call follow up

Calling people takes away the protective layer of anonymity that emails provide — making it MUCH harder to ignore your payment request. Our suggestion is to call first.

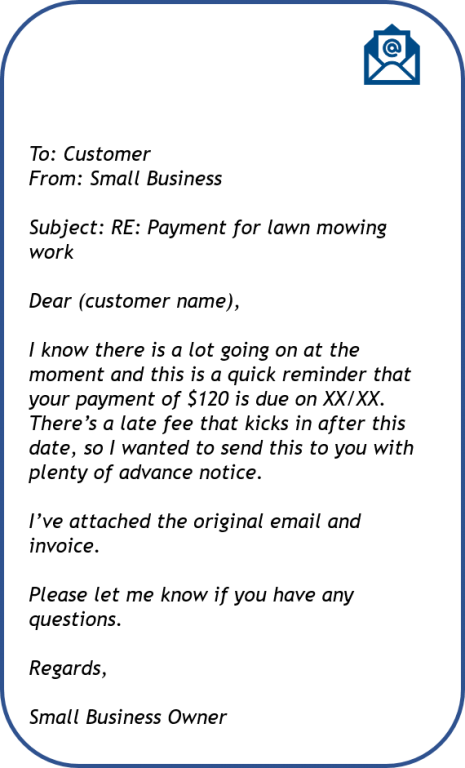

After your phone call follow up make sure you close the loop with an email that reads something like the email above.

Kris Young, Many Rivers local business coach in Broome suggests, “if a customer suggests something you are not comfortable with, don’t be afraid to say you need time to consider and come back to them”.

Email reminders

The key points to remember are: be polite and friendly, remind the customer of the work done and the date completed/supplied, the amount owing and remind them of your payment options. Be straightforward and make sure your subject line is clear and to the point, remaining polite at all times.

The best thing about this email follow up is that it is simple and actionable. It should work for most customers, most of the time.

If you have still not been paid after a period of time it’s time for another follow up. Your second email follow up could read something like the second image above. This email is still friendly, simple and actionable. By following up before the late fee kicks in you are trying to help them and you are acknowledging there is “a lot going on at the moment”. You also have included the original email and invoice for their reference.

Good follow up will make sure you have remained polite and been respectful to your customer. You have got the result you needed and both you and your customer still have a relationship to continue doing business in the future.

What if they still do not pay?

If still do not have payment you have 3 options:

- Cut ties with the customer. If the amount owing is small, or relative to the amount of effort you are spending on your follow up, not worth any more effort (Remember: your time is money so at some point it becomes unprofitable to keep spending time on this follow up) you may decide to cut ties with your customer and not do any more work for them. You need to value your time and energy by not wasting either on bad customers.

- Be annoyingly persistent. Keep sending your polite follow up emails and phone calls, every day, until they pay. The amount of time you spend on this should be worth the result. You will need to make sure you keep your cool during these emails and phone calls because it’ll be easier now to get angry at them. Stay polite. Eventually you hope that the customer wants to stop your follow up and pays.

- Consider a collection agency. For very large payments that are outstanding you may have to resort to a collection agency. Only use this option when you really, really have to and you have no other choices. Make sure you have records of what is owing and all your follow up communications on file. Make sure you use a reputable agency.

Following up on outstanding payments is always important, even more so now. If you are an existing Many Rivers client and have questions about how to approach this, please get in touch with your business coach, they are here to help. You can click here to read a summary of the Top 10 Tips to protect your business.

For new clients, Many Rivers is here to help people start small businesses and grow existing businesses. We are here to support you the whole way. Please take the Small Business Self Assessment and see if we are right for you.